Reduce Medical Practice Expenses

Are you struggling to keep your medical practice financially stable? Searching for effective ways to cut costs and boost your bottom line? You’re not alone. In this post, we’ll share our proven strategies to reduce medical practice expenses—including how we helped one practice save an impressive $260,000!

A frequent concern among physicians is the frustrating reality of working harder while earning less. On one hand, declining reimbursements and relentless claim denials from insurance companies are well-known challenges. But what about the other side of the equation? Have you taken a closer look at your practice’s spending—where the money is going and how it’s being used?

When Cornerstone Healthcare Consulting and Management evaluates your practice, one of the first items we request is a detailed expense report from the past 12 months. This report provides valuable insights into areas where you may be overspending, allowing us to identify quick wins for cost savings.

For instance, we prioritize analyzing your medical supply and medical waste expenses. In the case of medical waste, one vendor in particular has a reputation for overcharging medical practices. By addressing this issue, we have helped clients save thousands of dollars on waste management alone.

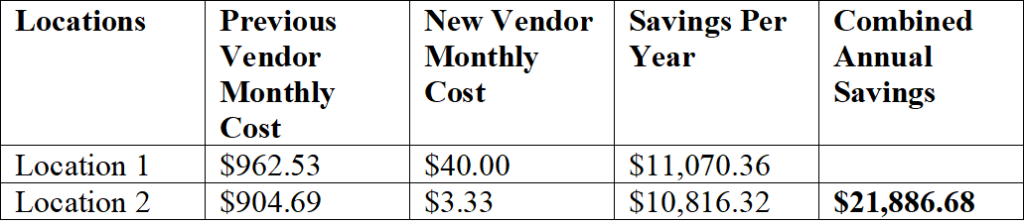

To illustrate, here’s an example from a former client with two locations. Their original vendor was significantly overcharging for waste services, but after switching to a new vendor, they achieved substantial savings. The comparison below highlights the costs under the previous vendor versus the current one, along with the total savings realized.

This case represented significant cost savings for the client, and while it might seem like an isolated incident, it was far from unique. Time and again, when we encounter this particular vendor, it’s clear the client is overpaying. Many medical practices are simply unaware that alternatives exist. Even when they suspect other vendors might be available, they often have no idea where to begin their search.

Compounding the issue, clients frequently find themselves locked into restrictive contracts, believing there’s no way out. This vendor has even faced a lawsuit in New York for breaching contractual law by failing to notify clients within the required 60 days that their contracts were set to renew. As a result, many practices were unknowingly locked into extended agreements at inflated rates. Thankfully, the lawsuit was resolved in favor of the clients, setting a precedent we’ve successfully used to help other clients break free from these contracts.

We always take a close look at the vendors practices use for their medical supplies, as some are notorious for overcharging. We recommend a preferred medical supply vendor that many physicians aren’t even aware of. In every instance we’ve worked with them, they’ve saved our clients over 20% on supply costs. In some cases, simply switching to this vendor has prompted the previous supplier to suddenly match those lower prices—proof that they were charging more than necessary all along. The problem is, if no one is monitoring year-over-year price increases or exploring alternative vendors, these overcharges go unnoticed, allowing suppliers to continue inflating costs.

Employee benefits present another significant opportunity for cost savings. As highlighted in our previous blog, The One-Stop Shop for Doctors, both retirement and health plans often require careful review and updates. Within the Cornerstone Network, we collaborate with trusted professionals who consistently deliver exceptional results for our clients.

For retirement planning, as well as life and disability insurance, we rely on Planned Futures Financial. Specializing in the medical industry, they’ve proven to be a valuable partner. In one notable case, they saved a client over $40,000 by reducing retirement plan expenses, lowering group disability insurance costs, and eliminating TPA fees.

For health insurance, Azeros Health Plans is our go-to solution. Co-owners Ron Zoeller and Kevin Gannon bring years of experience from running their own companies before founding Azeros together. Beyond optimizing health plans, we also work closely with Azeros on Direct Primary Care initiatives, further streamlining healthcare costs for our clients.

By leveraging these strategic partnerships, we help ensure our clients maximize savings while maintaining top-tier benefits for their teams.

Our primary goal is to help you save money, but we also believe in ensuring you have the right resources to run your practice effectively. If that means recommending a new vendor that might cost a bit more but provides the coverage you truly need, we won’t hesitate to do so. One example of this is your business insurance.

We work closely with Steinmiller Insurance, specialists in medical practice coverage. They have a deep understanding of HIPAA regulations and the critical importance of data protection. When reviewing your current insurance, they may be able to match your coverage and save you money. However, they might also identify gaps in your coverage and recommend adding essential protections. While this could increase costs slightly, it could save you from much larger risks down the road.

When analyzing your expenses, we go beyond just targeting the obvious or the biggest costs. Our approach is comprehensive—we meticulously review every detail, big or small. Beyond providing recommendations, we actively assist in implementing them. From expense analysis and vendor negotiations to executing changes, we’re with you every step of the way. Our experience spans everything from inventory audits and installing new phone systems to transitioning from server-based EMR to cloud-based solutions.

As insurance reimbursements continue to decline, reducing expenses has become a top priority for medical practices. Let us help you streamline your operations and cut costs. Schedule a consultation today, and let’s get started!